- SovereignBeat

- Posts

- Trump launches memecoin

Trump launches memecoin

bitcoin spikes again above 100k

Welcome back to SovereignBeat!

Cooling inflation drives yields lower

ECB set for another rate cut in January

Germany contracts for second straight year

China hits 5% growth target

Trump's crypto ball debuts $TRUMP memecoin; Melania joins in

Let’s dissect

We Also Recommend

Pay No Interest Until Nearly 2027 AND Earn 5% Cash Back

Some credit cards can help you get out of debt faster with a 0% intro APR on balance transfers. Transfer your balance, pay it down interest-free, and save money. FinanceBuzz reviewed top cards and found the best options—one even offers 0% APR into 2027 + 5% cash back!

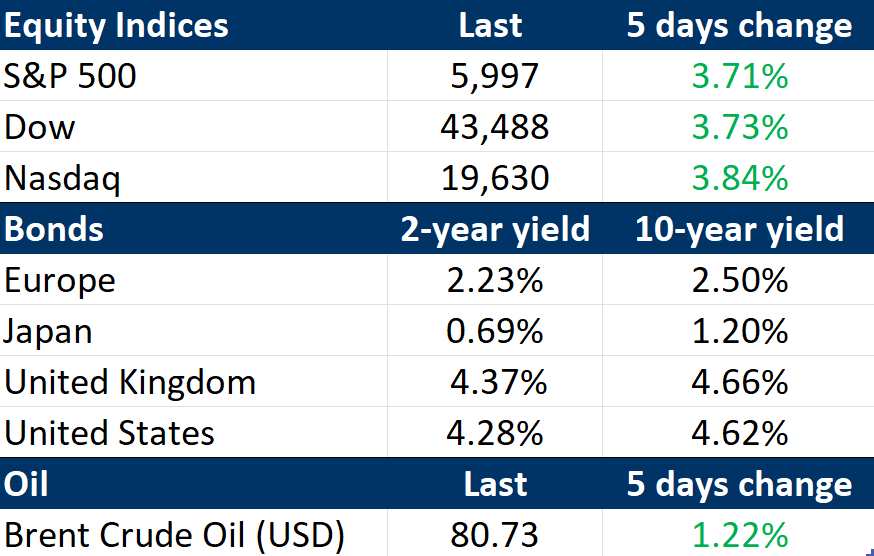

Markets Snapshot

As of 17/01/2025 market close

Macro and Fixed Income Markets

US: This week’s economic focus was on Wednesday’s release of the December 2024 inflation report from the Labor Department. The report brought some relief, as Core CPI, which excludes volatile food and energy prices, rose by a softer-than-anticipated 0.2% month-over-month (MoM), following four consecutive months of 0.3% increases. On an annual basis, Core CPI grew by 3.2%, showing a slight slowdown from November’s 3.3% year-over-year (YoY) rise. Headline CPI met expectations, registering a 0.4% MoM increase in December, while YoY it advanced by 2.9%, up from 2.7% in the previous month.

Despite these figures, they are unlikely to prompt the Federal Reserve to reduce interest rates at its upcoming January meeting, with market expectations suggesting nearly a 100% probability of rates remaining steady. However, the data suggests continued progress in curbing inflation, potentially paving the way for rate cuts later in the year.

On Thursday, the Commerce Department released data showing that U.S. retail sales grew by 0.4% in December, following a 0.8% increase in November. The latest figure came in below market expectations, which had anticipated a 0.6% rise.

In response to the inflation and retail sales reports, U.S. Treasury yields eased from their highest levels in over 14 months, reversing an upward trend that had persisted since last September. The yield on the 10-year Treasury note settled at 4.62% by the end of the week, a decline from the previous week's 4.77%.

EU: The European Central Bank (ECB) emphasized the need for a cautious and gradual approach to lowering interest rates, according to the minutes from its December monetary policy meeting, where rates were cut for the third consecutive time. Market expectations point to another quarter-point reduction in the deposit rate to 2.75% at the upcoming policy meeting at the end of January.

China: Economy grew at an annual rate of 5.4% in the fourth quarter, surpassing most economists' forecasts and improving from the 4.6% expansion recorded in the previous quarter. For the full year 2024, the economy achieved a growth rate of 5.0%, aligning with the government’s official target.

UK: Annual consumer price growth in the UK unexpectedly eased to 2.5% in December, down from 2.6% in November, strengthening market expectations that the Bank of England could begin cutting interest rates as early as February. Signs of easing inflationary pressures were also evident, with services inflation—a key metric for policymakers—falling to a nearly three-year low of 4.4% from 5%. Meanwhile, core inflation, which strips out food and energy costs, declined to 3.2% from 3.5%.

However, economic growth remained tepid, with GDP expanding by just 0.1% in November. While this marked an improvement from contractions in the prior two months, it fell short of the anticipated 0.2% growth. Consumer demand remained weak, with retail sales volumes estimated to have declined by 0.3% in December, a crucial holiday shopping period, following a modest 0.1% rise in November. Analysts had expected a 0.4% increase.

Germany: Europe's largest economy, recorded a slight contraction for the second consecutive year, with GDP shrinking by 0.2% in 2024 following a 0.3% decline in 2023. The downturn was driven by sluggish consumer spending and intensified competition facing the country's automotive industry, which continues to weigh on economic performance.

Equity Markets

US: After a sluggish start to the week, U.S. stocks surged on Wednesday and Friday, driving major indexes to weekly gains of almost 4%. This marked only the second positive week in the past six for the S&P 500, which ended Friday less than 2% below its record high set on December 6.

Earnings reports from major U.S. banks surpassed market expectations, with three institutions posting fourth-quarter profits that more than doubled compared to the same period last year. Ahead of the earnings season, analysts had projected nearly 40% year-over-year growth for the S&P 500 financial sector—making it the best-performing sector among all 11.

Commodities

Oil: Bitcoin's price surged on Friday and Saturday, approaching its all-time high from a month ago. The cryptocurrency traded around $106,300 on Saturday night, rising from $94,500 at the end of the previous week. Its record peak of approximately $108,000 was set on December 17. The latest price spike followed former President Donald Trump's "Crypto Ball," where he unveiled his new memecoin, $TRUMP, sparking fresh enthusiasm in the market.

Thank you for checking out the latest SovereignBeat newsletter! Share your thoughts on the topics covered and let us know if there's anything specific you'd like us to explore.

Read our other publications here

Reply